Payletter Payment Service

Introduction

No matter how many times you think, Payletter is your partner at all times.

Payletter provides an electronic payment service for sales of product at online store

We are trying our best to provide the most convenient payment service with our capability in stable transaction processing,

various kinds of payment method and security certification

| 1. 260 partners in 25 countries |

| 2. Stable payment environment with PCI-DSS(Global Credit Card data security standard, ISMS (Data security standard certificated in local organization) |

| 3. Proven capability in transaction processing from experience in working with local No.1 e-commerce, music streaming and VOD service |

| 4. Stable service and settlement in basis of solid financial structure |

| 5. Exceptional response service compared to other payment services. (98.7% successful with response) |

Payment Method and Additional Service

| Finance | Simple Payment | Telecom | Voucher | Prepaid Card | Additional Service |

|---|---|---|---|---|---|

| Credit card Internet Banking Virtual account |

TOSS kakaopay PAYCO SSGPAY Bank Account Naver Pay SamsungPay applepay |

Mobile Phone | Voucher Culture Voucher Smart Culture Voucher Book Culture Voucher |

Teen Cash CVS Cash Eggmoney Transportation Card (T-money, Cashbee) Transportation Card (EZL) |

Authentication |

How to Apply to

| Partnership Inquiry : globalpg@payletter.com |

|---|

| 1. Apply for Payletter Service in Online |

| 2. Service Review View Unavailable Service |

| 3. Guarantee Insurance - Inquiry: Seoul Guarantee Insurance Seocho Office [Guaranteeinsur Corp / +82-2-3486-0021 or +82-2-3487-0035] |

| 4. Submit a Contract and required document View a contract |

| 5. Review for Each Payment Method - Credit Card/Simple Payment/Mobile: 2 Weeks in general - Internet Banking: 1~2 Days in general - Voucher/Prepaid Card: 3~5 Days in general |

| 6. Make a Payment for Registration Fee and Finish an application |

Required Document

| Division | Corporate Business | Individual Business |

|---|---|---|

| Contract Document | 1. 2 Copies of PayoneQ Service Agreement 2. 1 Copy of personal information Agreement |

|

| Required Document | 1. 1 Copy of Certificate of Business 2. 1 Original copy of Certificate of Corporate Seal Impression (Issued within 3 months) 3. 1 Copy of Bankbook in name of Corporate 4. 1 Copy of Usesignet Seal (In case of being stamped with usesignet in Contract.) 5. 1 Original Copy of Guarantee Insurance |

1. 1 Copy of Certificate of Business 2. 1 Copy of Certificate of Seal Impression in Name of Representative (Issued within 3 months) 3. 1 Copy of Bankbook in name of Representative or Corporate 4. 1 Original Copy of Guarantee Insurance |

Integration preparation

API HTTPS Protocol

Supportive HTTPS Protocol

Payletter API HTTPS supports TLS 1.2 or higher.

Firewall

Please add inbound IP in order to receive a callback for payment completion.

Test : 211.115.120.167

Live : 211.115.72.37, 211.115.72.38, 211.115.120.37, 211.115.120.38

API Authorization

API Key will be issued once contract is completed. Guide for Contract

Please find out API Key in admin page for merchant.

Each API Key for Payment and Search will be separately issued.

Please send API Key for HttpRequestHeader authorization as follows.

Authorization: PLKEY {APIKey of Client}

API Endpoint URL

| Environment | Address |

|---|---|

| TEST | https://testpgapi.payletter.com/ |

| LIVE | https://pgapi.payletter.com/ |

It is available to reach the callback_url through only 80,443 port on test environment. So it is require to firewall registration, if you want to use other port.

Please let us know the your IP and port through the technical service team email (poqdev@payletter.com).

Client Information for Test Environment

Integration test in test environment is available through API Key before registering.

| Parameter | Value |

|---|---|

| Client ID | pay_test |

| API Key (PAYMENT) | MTFBNTAzNTEwNDAxQUIyMjlCQzgwNTg1MkU4MkZENDA= |

| API Key (SEARCH) | MUI3MjM0RUExQTgyRDA1ODZGRDUyOEM4OTY2QTVCN0Y= |

Information by Payment Method

| Payment Method | Recurring Payment | Cancellation | Partial Cancellation | Cancellation Period | Minimum Approval Amount (KRW) |

|---|---|---|---|---|---|

| Credit Card | O | O | O | D+180 | 100 |

| Bank Transfer | X | O | O | the day of transaction | 1000 |

| Virtual Account | X | X | X | Non-available | 500 |

| TOSS | X | O | O | D+180 | 1 |

| kakaopay | O | O | O | D+180 | 100 |

| PAYCO | O | O | O | D+180 | 100 |

| SSGPAY | X | O | O | D+180 | 100 |

| Naver Pay | X | O | O | D+180 | 100 |

| SamsungPay | X | O | O | D+180 | 100 |

| applepay | X | O | X | D+180 | 1 |

| CHECKPAY | O | O | X | D+30 | 1000 |

| Voucher | X | O | X | D+24 | 1 |

| Culture Voucher | X | O | O | D+24 | 5000 |

| Smart Culture Voucher | X | O | X | D+24 | 1 |

| Book Voucher | X | O | O | D+24 | 1 |

| Teencash | X | O | X | D+24 | 10 |

| Convenience Cash | X | O | X | D+24 | 10 |

| Eggmoney | X | O | X | D+24 | 10 |

| Transportation Card(T-money, Cashbee) | X | O | O | D+24 | 10 |

| Transportation Card(EZL) | X | O | X | D+24 | 10 |

Notice

Payment Method

| 1. In case of Naver Pay and Smile Pay, according to the selected payment option by the end-user

the value of PG Code is set differently in the request of Callback URL. (Naver Pay : navercard or naverpoint) |

| 2. Need to Tmoney APP (Tmonet Charging Payment Module) on the google paly store when Mobile Tmoney payment. |

| 3. Need to EZL APP (EZL Charging Payment Module) on the google paly store when Mobile EZL payment. |

| 4. In case of SSGPAY, shoud be member’s mobile number of SSGPAY. |

| 5. SSGPAY, SamsungPay and Toss, service_name is must value. |

| 6. Allowed to use : Hyundai Card ○ Usable to above iOS 11.3, MacOS 10.12.6, Safari 11.1 on MacOS. ○ iPhone, iPad : Recommend to use Safari browser.(Support all browser) ○ MacBock : Support to Safari browser only. ○ It can be registered a Hyundai Card to digital wallet by contacting the Hyundai Card customer service if user have a WiFi-only iPad. |

| 7. Please be informed that some payment methods may have limited functionality in an iframe environment. To ensure a smooth payment process, we kindly ask you to avoid using iframes whenever possible. |

Payment Testing

| 1. For creditcard test, VAN(Creditcard) communication is not supported. |

| 2. For kakaopay, mobile payment and SSGPAY test, the actual payments occurs in the test environment. (Those payments are cancelled automatically at the same day of the payments.) |

| 3. For virtual account test, the step of “acquiring virtual account number” is the limit. Cancellation is not available if you make payment to the virtual account. (If you need to test the step of actual payment, please contact us.) |

| 4. No actual payment are made through test payments with Applypay. |

| 5. For Internet banking, vouchers, pre-paid card tests, please contact us. |

| 6. Credit card payment test in test environment, mobile authentication number is not available. (Possible to put any number for testing) |

Technical Support

poqdev@payletter.com

For a quicker response, please provide detailed information such as integration environment, client ID, invoice number, time of transaction, token and related others. It would be useful for support.

API Information

List of API

| URL | METHOD | KEY TYPE | FEATURES |

|---|---|---|---|

| v1.0/payments/request | POST | PAYMENT | PAYMENT REQUEST |

| v1.0/payments/request | POST | PAYMENT | Recurring Payment |

| v1.0/payments/autopay | POST | PAYMENT | Recurring Payment Approval |

| v1.0/payments/cancel | POST | PAYMENT | PAYMENT CANCELLATION |

| v1.0/payments/cancel/partial | POST | PAYMENT | PARTIAL CANCELLATION |

| v1.0/cashreceipt/issue/{tid} | POST | PAYMENT | ISSUE CASH RECEIPT (E-INVOICE) |

| v1.0/payments/transaction/list | GET | SEARCH | SEARCH PAYMENT HISTORY |

| v1.0/payments/partner/transaction/list | GET | SEARCH | SEARCH PARTNER PAYMENT HISTORY |

| v1.0/receipt/info/{tid} | GET | SEARCH | TRANSACTION HISTORY CONFIRMATION |

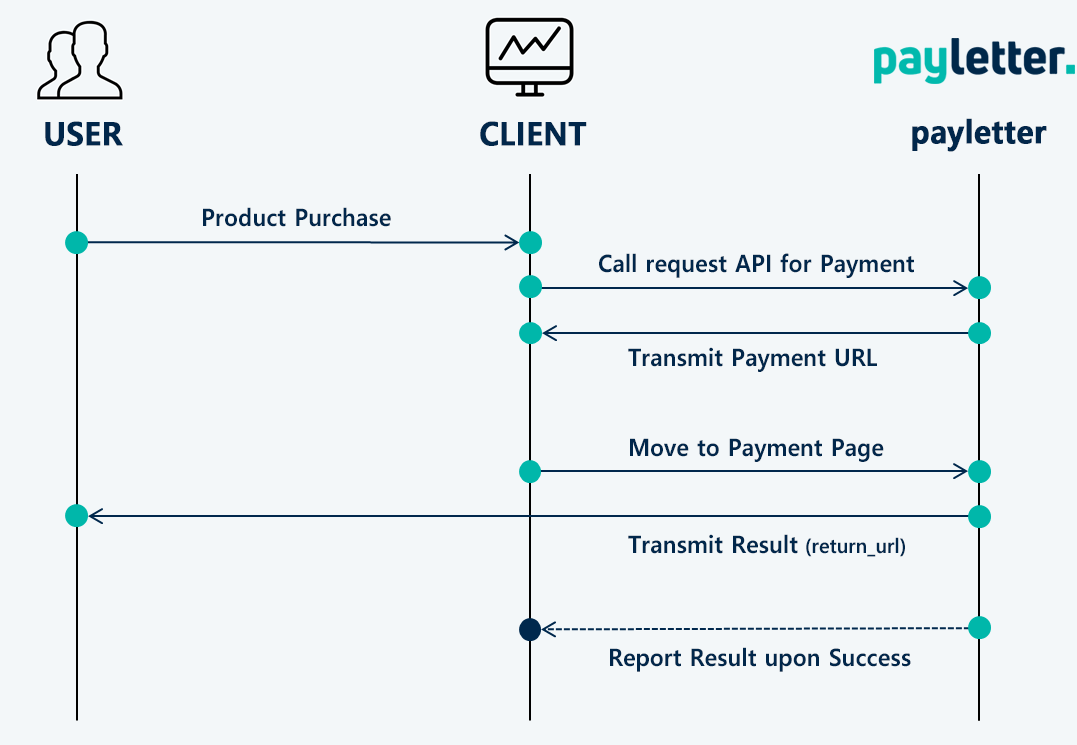

Payment Process

API Sample Source

The available programming languages for API sample sources of PAYLETTER are ASP, ASP.NET, JSP, PHP.

| Programming Language | Sample Source |

|---|---|

| ASP | Download |

| ASP.NET | Download |

| JSP | Download |

| PHP | Download |

| Node.js | Download |

Payment Request

Request

POST /v1.0/payments/request HTTP/1.1

Host: testpgapi.payletter.com

Authorization: PLKEY MTFBNTAzNTEwNDAxQUIyMjlCQzgwNTg1MkU4MkZENDA=

Content-Type: application/json

{

"pgcode" : "mobile",

"user_id":"test_user_id",

"user_name":"tester",

"service_name":"payletter",

"client_id":"pay_test",

"order_no":"1234567890",

"amount":1000,

"product_name":"test product",

"email_flag":"Y",

"email_addr":"payletter@payletter.com",

"autopay_flag":"N",

"receipt_flag":"Y",

"custom_parameter":"this is custom parameter",

"return_url":"https://testpg.payletter.com/result",

"callback_url":"https://testpg.payletter.com/callback",

"cancel_url":"https://testpg.payletter.com/cancel"

}

Key Type

PAYMENT

HTTP Request

POST v1.0/payments/request

Request Parameters

| Parameter | Default | Type | Size | Description |

|---|---|---|---|---|

| pgcode | Necessary | string | 20 | Payment method Code Refer to Appendix |

| client_id | Necessary | string | 20 | Client ID |

| service_name | string | 20 | Name of Service (Mandatory - SSGPAY, SamsungPay, Toss) | |

| user_id | Necessary | string | 50 | Paid User(Member) ID (e-mail, English and number are available) |

| user_name | string | 20 | Name of User | |

| order_no | string | 50 | Order Number (Only alphanumeric characters are allowed) | |

| amount | Necessary | number | Payment Amount Exception) In case pgcode is voucher, it's only allowed to set 5000/10000/50000 as a value. |

|

| taxfree_amount | number | tax-free should be same as amount compound tax |

||

| tax_amount | number | VAT (if it is null, (amount-tax-free)/11 : Automatically calculated the result rounded up to after the decimal point ) | ||

| product_name | Necessary | string | 100 | Name of Product (Not allowed to use control character such as <, > , carriage return (\n)) |

| email_flag | string | 1 | Receive e-mail for payment details or not (Y/N) | |

| email_addr | string | 100 | Receiving e-mail address for payment details. | |

| autopay_flag | string | 1 | Recurring Payment or not | |

| receipt_flag | string | 1 | Show a page for inputting cash receipt or not (Y/N) (* Only available in case of contract for cash receipt. Not applicable to foreign corporations.) |

|

| keyin_flag | string | 1 | Credit Card Payment by hand (*Separate Contracts is necessary) |

|

| custom_parameter | string | 1024 | Random value transmitted by client ex) Return to payment result in case user Information, Order Information and any other details are set up |

|

| return_url | Necessary | string | 256 | Linked webpage URL after completing payment |

| callback_url | Necessary | string | 256 | Callback URL to receive payment success results (Process payment in success) |

| cancel_url | string | 256 | Linked webpage URL after clicking a cancellation button Naver Pay,SamsungPay - It's not redirect to cancel_url. |

|

| inapp_flag | string | 1 | In-app or not (Y/N) | |

| app_return_url | string | 256 | Linked webpage URL in case of payment with ISP/KFTC (Account Transfer) from In-app (Ex:IOS - App Address://, Android - App Address://ISPSuccess) |

|

| app_cancel_url | string | 256 | Linked webpage URL after payment cancellation with ISP/KFTC (Account Transfer) from In-app (Ex:IOS - App Address://, Android - App Address:ISPCancel) |

|

| expire_date | string | 8 | Set expiry date for virtual account (YYYYMMDD) | |

| expire_time | string | 4 | Set expiry time for virtual account (HHMM) | |

| disposable_cup_deposit | number | Disposable cup deposit (* Allowe to part of payments, Not allowe to partial cancellation) * Allowe to part of payments : Credit Card , Naver Pay, Kakaopay, Toss, SSGPay, Transportation Card (Tmoney/Cashbee), Mobile |

||

| company_name_flag | string | 1 | Display of merchant name within the card payment authentication window (Y: Display merchant name, N: Display Payletter, Applied Credit Card only) |

[Process of InApp payment]

General Details

When integrating in-app payments, Payletter’s payment page should be implemented as mobile WebView and

should be able to call external app for the payments of card companies and each institutions.

An app scheme should be added to call external apps. Please find the attached file for the

app scheme values based on the mobile OS.

Android

Using the shouldOverrideUrlLoading() function of WebViewClient when moving to external apps

1) If @Override is not added to the redefined shouldOverrideUrlLoading() function,

net::ERR_UNKNOWN_URL_SCHEME error may occur.

2) In case of verify whether an app is installed, search the package information before

the call startActivity(). In case of checking package information before calling startActivity()

to confirm if the app is installed Remove the installation check logic and immediately call startActivity().

3) When calling startActivity, if an ActivityNotFoundException(Message : No Activity found to

handle Intent) is thrown, the app is assumed to be uninstalled and the user is directed to

the market to install the app.

Notes for developing on Android 11 (API 30)

According to Google's security policy, if you set your app's targetSdkVersion to 30 or higher,

you must take the following actions.

1) Set the usesCleartextTraffic property to true in the AndroidManifest.xml file to avoid the net:

ERR_CLEARTEXT_NOT_PERMITTED error.

2) To check the status of other packages within the app, define the package in the "queries"

element of the AndroidManifest.xml for visibility.

3) Please see the attachments for the package names of the card companies and vaccines.

ios

After getting the URL of the payment page through the REST API, you can use the WEBVIEW method to open the checkout page.

Register the necessary App Scheme in info.plist for calling external apps from the webview.

If you list the App Scheme in info.plist, a window asking to run an external app

will pop up and it will be automatically processed.

1) In iOS 9.0 or higher, LSApplicationQueriesSchemes is added as a security policy enhancement.

When opening external apps using URL schemes, this is to increase security by allowing

only schemes registered in the whitelist to be opened. To open a card company/institution app,

you need to add a whitelist (allowlist, info.plist).

2) In iOS 6.0 or higher, Safari's cookie preferences have been changed to allow sessions to be

maintained only when always set, which may cause a session expiration error.

Please set cookies to always allow.

Response Parameters

Response (success)

HTTP 1.1 200 OK

{

"token" : 153438847514600001,

"online_url": "https://testpg.payletter.com/pgsvc/hub.asp?location=online&token=153438847514601",

"mobile_url": "https://testpg.payletter.com/pgsvc/hub.asp?location=mobile&token=153438847514601"

}

Response (failure)

HTTP 1.1 401 Unauthorized

{

"code": 998,

"message": "Authentication token is missing or incorrect"

}

In case of success

| Parameter | Type | Description |

|---|---|---|

| token | number | Payment Authentication Token |

| online_url | string | Payment Page Call URL in PC |

| mobile_url | string | Payment Page Call URL in Mobile |

In case of failure

| Parameter | Type | Description |

|---|---|---|

| code | number | Error Code |

| message | string | Error Message |

Payment Integration

Please call payment page using URL returned to payment request API Response.

When a user proceeds with a payment, the payment result is returned to the return_url and callback_url (only in case of successful payment) that you provided in the payment request.

Please refer to following instruction on process of return_url and callback_url.

* callback_url integration is essential for the payment methods as TOSS, Checkpay, Virtual account.

Return URL

Payment result is transmitted to POST parameter in Request.

In case of success

| Parameter | Type | Description |

|---|---|---|

| code | string | Result |

| message | string | Message |

| user_id | string | Paid User(Member) ID |

| user_name | string | Name of User |

| order_no | string | Order Number |

| service_name | string | Name of Service |

| product_name | string | Name of Product |

| custom_parameter | string | Transmitted value from Client |

| tid | string | Unique Payment Number |

| cid | string | Approval Number |

| amount | number | Requested Payment Amount | taxfree_amount | number | tax-free should be same as amount compound tax |

| tax_amount | number | VAT (if it is null, (amount-tax-free)/11 : Automatically calculated the result rounded up to after the decimal point) |

| pay_info | string | Additional Information for Payment |

| pgcode | string | Name of payment gateway |

| billkey | string | Recurring Payment Billkey for re-payment |

| domestic_flag | string | Domestic/Overseas Credit Card (Y: Overseas, N: Domestic) |

| transaction_date | string | Transaction Date (YYYY-MM-DD HH:MM:SS) |

| install_month | number | Month of Installment |

| card_info | string | Card Number (Middle of 6 digit under masking) general payment (creditcard, payco) and Recurring Payment (creditcard, payco) only |

| payhash | string | sha256 hash value to verify parameter Sha256(user_id +amount + tid +API Key for payment) (Recurring payment) When it is requested without a payment amount , Sha256 will be 'user_id + billkey + API Key for payment' * Part of payment methods are not received. For example, virtual count) |

| disposable_cup_deposit | number | Requested disposable cup deposit |

| Virtual account | ||

| account_no | string | Number of Virtual Account |

| account_name | string | Depositor Name for Virtual Accont |

| account_holder | string | Account Name |

| bank_code | string | Bank Code |

| bank_name | string | Name of Bank |

| issue_tid | string | Virtual Account Issuance Approval Number |

| expire_date | string | Expiry Date (ex: 20210808) |

| expire_time | string | Expiry Time (ex: 1130) |

| Cash Receipt | ||

| cash_receipt_code | string | Fail Result of Receipt |

| cash_receipt_message | string | Fail Message |

| cash_receipt_type | string | Use for(01:Tax Deduction, 02:Proof of expense) |

| cash_receipt_issue_type | string | Issuing Cash Receipt (1:By Buyer, 2:By oneself) |

| cash_receipt_cid | string | Approval Number of Cash Receipt |

| cash_receipt_payer_sid | string | Identification Number(Cellphone Number, Business License) |

| cash_receipt_deal_no | string | Transferred order number with issued cash receipt |

In case of failure

| Parameter | Type | Description |

|---|---|---|

| code | string | Result |

| message | string | Message |

| user_id | string | Paid User(Member) ID |

| order_no | string | Order Number |

| service_name | string | Name of Service |

| product_name | string | Name of Product |

| custom_parameter | string | Transmitted value from Client |

Callback URL

{

"user_id":"test_user_id",

"user_name":"tester",

"amount":1000,

"tid":"tpay_test-201808162396515",

"cid":"20180816150336996237",

"order_no":"1234567890",

"service_name":"payletter",

"product_name":"testproduct",

"custom_parameter":"this is custom parameter",

"transaction_date":"2018-08-16 15:03:52",

"pay_info":"0101234567",

"pgcode":"mobile",

"domestic_flag":"",

"billkey":"",

"card_info" : "457973******1234",

"payhash" : "9E078A29E6435959A07ED2E8415789234D18250434BAF2C185C2EF3012C77E92",

"disposable_cup_deposit" : 0,

"method_info" : "",

"coupon_amount" : 0,

"receipt_possible_amount" : 0,

"cash_receipt":

{

"code":"0",

"message":"message",

"cid":"xE7555915",

"deal_no":"1234567890",

"issue_type":"1",

"payer_sid":"01027160590",

"type":"01"

}

}

Only in the case of successful payments will be offered the result of payment as a format of json.

The CallbackUrl content, which is provided additionally along with the ReturnUrl data, is in the following format:

| Parameter | Type | Description |

|---|---|---|

| method_info | string | Main payment method of simple payment (Applied Payment Method: Naver Pay, kakaopay, SSGPAY, PAYCO, TOSS) ex) navercard : card navermoney : money kakaocard : card kakaomoney : money ssgpaycms : cms ssgpaycard : card ssgpaymoney : money tosscard : card tosspoint : money payco : The method used for payment |

| coupon_amount | number | Amount of coupon (Applied PAYCO only) |

| receipt_possible_amount | number | The amount eligible for cash receipt for rechargeable point of Payco |

| cash_receipt | object | |

| └ code | string | Result |

| └ message | string | Message |

| └ cid | string | Approval Number of Receipt |

| └ deal_no | string | Order number with issued cash receipt |

| └ issue_type | string | Issuing Cash Receipt (1:By Buyer, 2:By oneself) |

| └ payer_sid | string | Identification Number(Cellphone Number, Business License) |

| └ type | string | Usage (06:No need to issue, 01:Tax Deduction, 02:Proof of expense) |

It is preceded with logic such as charging, purchase and etc through transmitted Callback URL and needed to output following json string in case of success.

{"code":0, "message":"Failure reason in case of failure"}

In case of success, please transmit 0. On the contrary, please transmit other value except for 0.

If code is non-zero, the notification is considered it as failure and is retransmitted up to 20 times every 5 minutes.

The result can be found out in field of search failed notification history in client admin page (https://manager.payletter.com)

To protect parameter transmitted to Return Url / CallBack Url against forgery and falsification, please match with payhash after creating sha256 hash value.

[Guidance on Processing return_url and callback_url][return_url] The return_url operates through a page redirection method, which can be affected by the payer's device environment or network conditions. Therefore, the following situations may occur: - The payer may close the payment window or refresh the page before receiving the return_url - The return_url transmission may not be smooth depending on the network environment Consequently, it is recommended that the merchant's delivery of goods and key business logic after payment completion be processed through the callback_url. [callback_url] The payment result is transmitted only when the payment is successful. This minimizes the possibility of transaction discrepancies between the merchant and Payletter. As it operates through server-to-server communication, it allows for more stable data reception without being affected by network issues or device environments. [Recommended Processing Guidelines It is more stable to process the callback_url and return_url with independent logic. While the callback_url is typically processed first, the order of reception may vary depending on network conditions. Therefore, it is recommended to handle these two URLs separately. |

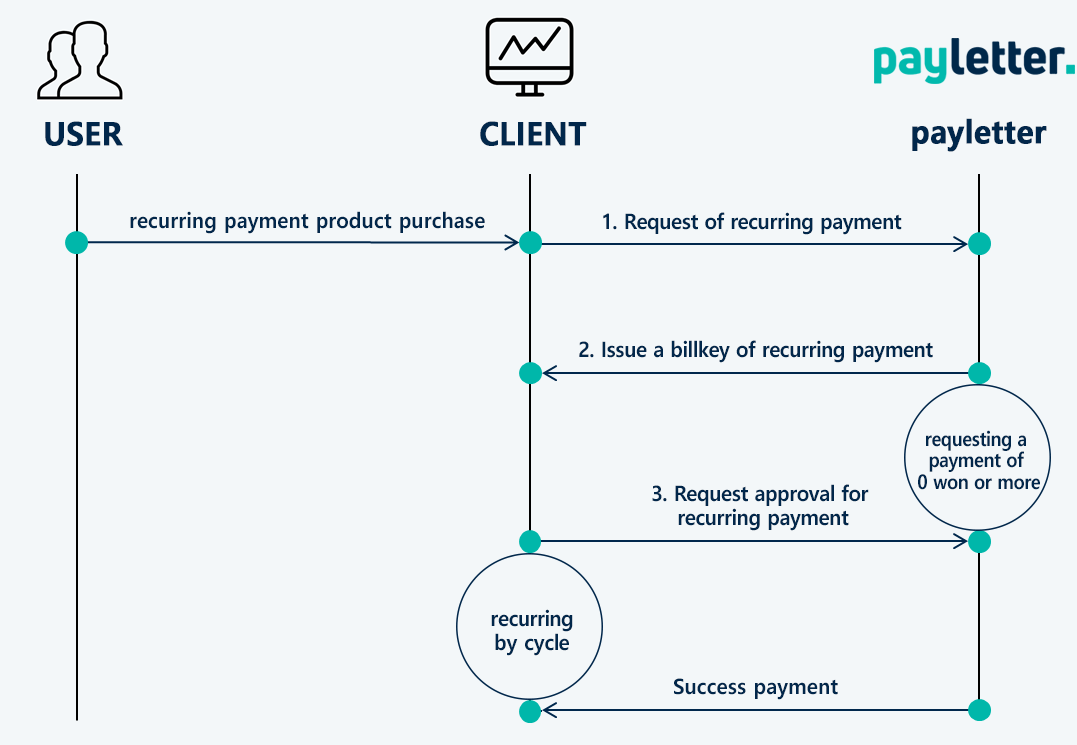

Recurring Payment

Recurring Payment is to request and process transactions at a time desired by the merchant after the first transaction.

1.Request of recurring payment

Request recurring payment through the Payment Request API(v1.0/payments/request) and set

whether to request recurring payment with autopay_flag parameter.

2.Issue a billkey of recurring payment

A billkey for recurring payment will be issued.

3.Request approval for recurring payment

A merchant can request approval with billkey through recurring payment API(v1.0/payments/autopay)

at the time the merchant needs the recurring payment.

Client Information for Test Environment

The recurring payment can be tested with the merchant ID and API Key below.

| Parameter | Value |

|---|---|

| ClientID | auto_test |

| API Key (PAYMENT) | NDBBREM2RjhEMENBQ0ZGODZDNkEyNEQxQUIxRTY5QUE= |

| API Key (SEARCH) | QjBCMjZBNUNBMEMzRDVDNzY2NkQ2OTU3QzFEQkM2QkY= |

[Payment Request without a payment amount]

If you would like to register the recurring payment without payment, request payment with the amount of ‘0’.

Only the billkey will be issued and you can request recurring payment approval with the billkey.

As actual payment was not occurred, the payment data will not be sent to callback_url.

The value of payhash is Sha256(user_id+billkey+API Key for PAYMENT).

setting is needed. Please contact to sales person who is in charge of.

Client Information for Test Environment

The recurring payment can be tested with the merchant ID and API Key below.

| Parameter | Value |

|---|---|

| ClientID | auto_test1 |

| API Key (PAYMENT) | NUMzRDJFQzVERkRBNTQzQjY1MkUzMTQ3NThFREU2Mzg= |

| API Key (SEARCH) | QUI4MUEyOEYxQTZFMTAxQjE4NjY3M0I5MjBDMzk1OEM= |

Recurring Payment Approval

Means that customer requests automatic payment with a Billkey which before got.

[Mobile recurring payment approval policy]

1. The payment should be requested as same amount and date.

2. The recurring payment approval request is available after 1month (about 30days) from the first payment.

3. The recurring payment approval is not available if there is no history of payment in last month.

Request

POST /v1.0/payments/autopay HTTP/1.1

Host: testpgapi.payletter.com

Authorization: PLKEY MTFBNTAzNTEwNDAxQUIyMjlCQzgwNTg1MkU4MkZENDA=

Content-Type: application/json

{

"pgcode" : "mobile",

"client_id":"pay_test",

"service_name":"payletter",

"user_id":"test_user_id",

"user_name":"tester",

"order_no":"1234567890",

"amount":1000,

"product_name":"testproduct",

"billkey":"tbpay_test201801012359590002",

"ip_addr":"127.0.0.1"

}

Key Type

PAYMENT

HTTP Request

POST v1.0/payments/autopay

Request Parameters

| Parameter | Default | Type | Size | Description |

|---|---|---|---|---|

| pgcode | Necessary | string | 20 | Payment method CodeRefer to Appendix |

| client_id | Necessary | string | 20 | Client ID |

| service_name | string | 20 | Name of Service | |

| user_id | Necessary | string | 50 | Paid User(Member) ID (e-mail, English and number are available) |

| user_name | string | 20 | Name of User | |

| order_no | string | 50 | Order Number (Only alphanumeric characters are allowed) | |

| amount | Necessary | number | Payment Amount | |

| taxfree_amount | number | tax-free should be same as amount compound tax |

||

| tax_amount | number | VAT (if it is null, (amount-tax-free)/11 : Automatically calculated the result rounded up to after the decimal point) | ||

| product_name | Necessary | string | 100 | Name of Product (Not allowed to use control character such as <, > , carriage return (\n)) |

| billkey | Necessary | string | 40 | Recurring Payment Billkey for re-payment (First time response parameter for Recurring Payment) |

| ip_addr | Necessary | string | 30 | Requested IP |

| disposable_cup_deposit | number | Disposable cup deposit (* Allowe to part of payments, Not allowe to partial cancellation) * Allowe to part of payments : Credit Card , Kakaopay |

Response Parameters

Response (success)

HTTP 1.1 200 OK

{

"tid" :"tpay_test201801012359590003",

"cid":"123456",

"amount":1000,

"billkey":"tbpay_test201801012359590002",

"transaction_date":"2018-01-01 23:59:59"

}

Response (failure)

HTTP 1.1 401 Unauthorized

{

"code": 998,

"message": "Authentication token is missing or incorrect"

}

In case of success

| Parameter | Type | Description |

|---|---|---|

| tid | string | Unique Payment Number |

| cid | string | Approval Number |

| amount | number | Payment Amount |

| billkey | string | Recurring Payment Billkey for re-payment |

| transaction_date | string | Date of Transaction (yyyy-MM-dd hh:mm:ss) |

In case of failure

| Parameter | Type | Description |

|---|---|---|

| code | number | Error code |

| message | string | Error Message |

Payment Cancellation

Request

POST /v1.0/payments/cancel HTTP/1.1

Host: testpgapi.payletter.com

Authorization: PLKEY MTFBNTAzNTEwNDAxQUIyMjlCQzgwNTg1MkU4MkZENDA=

Content-Type: application/json

{

"pgcode" : "mobile",

"client_id":"pay_test",

"user_id":"test_user_id",

"tid":"tpay_test2018010123595900001",

"ip_addr":"127.0.0.1"

}

Key Type

PAYMENT

HTTP Request

POST v1.0/payments/cancel

Request Parameters

| Parameter | Default | Type | Size | Description |

|---|---|---|---|---|

| pgcode | string | 20 | Payment method Code Refer to Appendix | |

| client_id | Necessary | string | 20 | Client ID |

| user_id | Necessary | string | 50 | Paid User(Member) ID (e-mail, English and number are available) |

| tid | Necessary | string | 40 | Unique Payment Number |

| ip_addr | Necessary | string | 30 | Request IP |

Response Parameters

Response (success)

HTTP 1.1 200 OK

{

"tid" :"tpay_test201801012359590003",

"cid":"123456",

"amount":1000,

"cancel_date":"2018-01-01 23:59:59"

}

Response (failure)

HTTP 1.1 401 Unauthorized

{

"code": 998,

"message": "Authentication token is missing or incorrect"

}

In case of success

| Parameter | Type | Description |

|---|---|---|

| tid | string | Unique Payment Number |

| cid | string | Approval Number |

| amount | number | Cancelled Amount |

| cancel_date | string | Date of Cancellation(YYYY-MM-DD HH:MM:SS) |

In case of failure

| Parameter | Type | Description |

|---|---|---|

| code | number | Error code |

| message | string | Error Message |

Partial Cancellation

Parts of payment methods are only available.

Please contact person in charge in advance.

Request

POST /v1.0/payments/cancel/partial HTTP/1.1

Host: testpgapi.payletter.com

Authorization: PLKEY MTFBNTAzNTEwNDAxQUIyMjlCQzgwNTg1MkU4MkZENDA=

Content-Type: application/json

{

"pgcode" : "mobile",

"client_id":"pay_test",

"user_id":"test_user_id",

"tid":"tpay_test2018010123595900001",

"amount" : 1000,

"taxfree_amount" : 100,

"tax_amount" : 20,

"ip_addr":"127.0.0.1"

}

Key Type

PAYMENT

HTTP Request

POST v1.0/payments/cancel/partial

Request Parameters

| Parameter | Default | Type | Size | Description |

|---|---|---|---|---|

| pgcode | Necessary | string | 20 | Payment method Code Refer to Appendix |

| client_id | Necessary | string | 20 | Client ID |

| user_id | Necessary | string | 50 | Paid User(Member) ID (e-mail, English and number are available) |

| tid | Necessary | string | 40 | Unique Payment Number |

| amount | Necessary | number | Cancelled Amount | |

| taxfree_amount | number | tax-free should be same as amount compound tax |

||

| tax_amount | number | VAT (if it is null, (amount-tax-free)/11 : Automatically calculated the result rounded up to after the decimal point) | ||

| ip_addr | Necessary | string | 30 | Request IP |

Response Parameters

Response (success)

HTTP 1.1 200 OK

{

"tid" :"tpay_test201801012359590003",

"cid":"123456",

"amount":1000,

"cancel_date":"2018-01-01 23:59:59"

}

Response (failure)

HTTP 1.1 401 Unauthorized

{

"code": 998,

"message": "Authentication token is missing or incorrect"

}

In case of success

| Parameter | Type | Description |

|---|---|---|

| tid | string | Unique Payment Number |

| cid | string | Approval Number |

| amount | number | Cancelled Amount |

| cancel_date | string | Date of Cancellation(YYYY-MM-DD HH:MM:SS) |

In case of failure

| Parameter | Type | Description |

|---|---|---|

| code | number | Error Code |

| message | string | Error Message |

Search Payment History

Request

GET /v1.0/payments/transaction/list?client_id=pay_test&date=20180918&date_type=transaction HTTP/1.1

Host: testpgapi.payletter.com

Authorization: PLKEY MUI3MjM0RUExQTgyRDA1ODZGRDUyOEM4OTY2QTVCN0Y=

Key Type

SEARCH

HTTP Request

GET v1.0/payments/transaction/list

Request Parameters

| Parameter | Default | Type | Size | Description |

|---|---|---|---|---|

| client_id | Necessary | string | 20 | Client ID |

| date | Necessary | string | 8 | Searching Date |

| date_type | Necessary | string | 20 | transaction: Transaction Date, settle : Payment/Cancellation Date |

| pgcode | string | 20 | Payment Method Code | |

| order_no | string | 50 | Order number (To be used only when viewing the details of a specific payment transaction.) |

date_type : Standard with Searching Transaction Status

transaction : Transaction Date

Extract payment status (success or cancellation) through transaction searched by standard of payment date (For example, cancelled payment will be extracted as 1 Cancelled Payment)

settle : Payment/Cancellation Date

Extract approval status in standard of payment date and cancellation in standard of Cancellation date (For example, cancelled payment will be extracted as 1 approval transaction in payment date and 1 cancelled payment in cancellation date)

Response Parameters

Response (success)

HTTP 1.1 200 OK

{

"total_count": 2,

"list": [

{

"pgcode": "oncash",

"user_id": "test_user_id",

"user_name": "tester",

"tid": "tpay_test-201809142506687",

"cid": "2506686",

"amount": 1000,

"order_no": "1234567890",

"product_name": "testproduct",

"status_code": 1,

"transaction_date": "2018-09-14 17:25:36",

"cancel_date": "2018-09-18 09:52:29"

},

{

"pgcode": "mobile",

"user_id": "test_user_id",

"user_name": "tester",

"tid": "tpay_test-201809182509659",

"cid": "20180918095312998861",

"amount": 100,

"order_no": "1234567890",

"product_name": "testproduct",

"status_code": 2,

"transaction_date": "2018-09-18 09:53:25",

"cancel_date": "2018-09-18 09:54:01"

}

]

}

Response (failure)

HTTP 1.1 401 Unauthorized

{

"code": 998,

"message": "Authentication token is missing or incorrect"

}

In case of success

| Parameter | Type | Description |

|---|---|---|

| total_count | number | Total number of searching |

| list | JSON Array | |

| pgcode | string | Payment Method Code |

| user_id | string | User ID |

| user_name | string | Name of User |

| tid | string | Unique Payment Number |

| cid | string | Approval Number |

| amount | number | Payment amount(For cancellation status, cancelled amount) |

| order_no | string | Order Number |

| product_name | string | Name of Product |

| status_code | number | Status(0:Approval, 1:Cancellation, 2:Partial Cancellation) |

| transaction_date | string | Date of Payment |

| cancel_date | string | Date of Cancellation |

In case of failure

| Parameter | Type | Description |

|---|---|---|

| code | number | Error code |

| message | string | Error Message |

Search Partner Payment History

Request

GET /v1.0/payments/partner/transaction/list?client_partner_id=ptnrsktet&date=20250825&date_type=transaction HTTP/1.1

Host: testpgapi.payletter.com

Authorization: PLKEY MUI3MjM0RUExQTgyRDA1ODZGRDUyOEM4OTY2QTVCN0Y=

Key Type

SEARCH

HTTP Request

GET v1.0/payments/partner/transaction/list

Request Parameters

| Parameter | Default | Type | Size | Description |

|---|---|---|---|---|

| client_partner_id | Necessary | string | 20 | Client ID |

| date | Necessary | string | 8 | Searching Date |

| date_type | Necessary | string | 20 | transaction: Transaction Date, settle : Payment/Cancellation Date |

| pgcode | string | 20 | Payment Method Code | |

| order_no | string | 50 | Order number (To be used only when viewing the details of a specific payment transaction.) |

date_type : Standard with Searching Transaction Status

transaction : Transaction Date

Extract payment status (success or cancellation) through transaction searched by standard of payment date (For example, cancelled payment will be extracted as 1 Cancelled Payment)

settle : Payment/Cancellation Date

Extract approval status in standard of payment date and cancellation in standard of Cancellation date (For example, cancelled payment will be extracted as 1 approval transaction in payment date and 1 cancelled payment in cancellation date)

Response Parameters

Response (success)

HTTP 1.1 200 OK

{

"total_count": 17,

"list": [

{

"pgcode": "creditcard",

"user_id": "test_user_id",

"user_name": "테스터",

"tid": "tpay_test-202508257865182",

"cid": "7865181",

"amount": 1000,

"taxfree_amount": 0,

"tax_amount": 20,

"order_no": "1234567890",

"product_name": "test product",

"status_code": 0,

"transaction_date": "2025-08-25 10:06:07",

"cancel_date": null,

"company_regnum": "114-86-05588",

"cat_id": "DPT0Q12738",

"card_no": "51184*******0475",

"allot_period": "00",

"card_kind": "TestCard",

"iss_van_card_code": "03",

"acq_van_card_code": "03",

"card_cpid": "00982863011",

"check_card_flag": 0

},

{

"pgcode": "creditcard",

"user_id": "1242049933",

"user_name": "",

"tid": "tpay_test-202508257865340",

"cid": "7865339",

"amount": 1000,

"taxfree_amount": 0,

"tax_amount": 91,

"order_no": "1756085811971",

"product_name": "test product",

"status_code": 0,

"transaction_date": "2025-08-25 10:38:03",

"cancel_date": null,

"company_regnum": "114-86-05588",

"cat_id": "DPT0Q23201",

"card_no": "40201*******8902",

"allot_period": "00",

"card_kind": "TestCard",

"iss_van_card_code": "08",

"acq_van_card_code": "08",

"card_cpid": "860554303",

"check_card_flag": 0

},

....

]

}

Response (failure)

HTTP 1.1 401 Unauthorized

{

"code": 998,

"message": "Authentication token is missing or incorrect"

}

In case of success

| Parameter | Type | Description |

|---|---|---|

| total_count | number | Total number of searching |

| list | JSON Array | |

| pgcode | string | Payment Method Code |

| user_id | string | User ID |

| user_name | string | Name of User |

| tid | string | Unique Payment Number |

| cid | string | Approval Number |

| amount | number | Payment amount(For cancellation status, cancelled amount) |

| order_no | string | Order Number |

| product_name | string | Name of Product |

| status_code | number | Status(0:Approval, 1:Cancellation, 2:Partial Cancellation) |

| transaction_date | string | Date of Payment |

| cancel_date | string | Date of Cancellation |

| company_regnum | string | company_regnum |

| cat_id | string | cat_id |

| card_no | string | Card Number (Masked) |

| allot_period | string | Installment Months |

| card_kind | string | card_kind |

| iss_van_card_code | string | Issuer Code |

| acq_van_card_code | string | Acquirer Code |

| card_cpid | string | Merchant ID |

| check_card_flag | number | Check Card Flag (1: Check Card, 0: Others) |

In case of failure

| Parameter | Type | Description |

|---|---|---|

| code | number | Error code |

| message | string | Error Message |

Issue Cash Receipt (e-Invoice)

Request

POST /v1.0/cashreceipt/issue/tpay_test-201904097449610 HTTP/1.1

Host: testpgapi.payletter.com

Authorization: PLKEY MTFBNTAzNTEwNDAxQUIyMjlCQzgwNTg1MkU4MkZENDA=

Content-Type: application/json

{

"client_id":"pay_test",

"type":"0",

"tax_flag":"N",

"return_url":"https://testpg.payletter.com/result"

}

Key Type

PAYMENT

HTTP Request

POST v1.0/cashreceipt/issue/{tid}

Request Parameters

| Parameter | Default | Type | Size | Description |

|---|---|---|---|---|

| client_id | Necessary | string | 20 | Store ID |

| type | string | 1 | Use for (0:Select by user, 1:Tax Deduction, 2:Proof of expense) | |

| tax_flag | string | 1 | VAT (N:Include, Y:Not Include) | |

| return_url | Necessary | string | 256 | Page URL to be connected upon issuing cash receipt |

Response Parameters

Response (success)

HTTP 1.1 200 OK

{

"receipt_url" :"https://testpg.payletter.com/PGSVC/Receipt/ReceiptForm.asp?id=tpay_test-201904097449610&type=1&taxflag=N&returnurl=https://testpg.payletter.com/result&token=155494822989700006"

}

Response (failure)

HTTP 1.1 401 Unauthorized

{

"code": 998,

"message": "Authentication token is missing or incorrect"

}

In case of success

| Parameter | Type | Description |

|---|---|---|

| receipt_url | string | Page URL for issuing cash receipt |

In case of failure

| Parameter | Type | Description |

|---|---|---|

| code | number | Error Code |

| message | string | Error Message |

Payment Status Check

Request

POST /v1.0/payments/status HTTP/1.1

Host: testpgapi.payletter.com

Authorization: PLKEY MTFBNTAzNTEwNDAxQUIyMjlCQzgwNTg1MkU4MkZENDA=

Content-Type: application/json

{

"client_id":"pay_test",

"order_no":"pay_test2023118164578"

}

Key Type

PAYMENT

HTTP Request

POST v1.0/payments/status

Request Parameters

| Parameter | Default | Type | Size | Description |

|---|---|---|---|---|

| client_id | Necessary | string | 20 | Client ID |

| order_no | Necessary | string | 50 | Order Number |

Response Parameters

Response (success)

HTTP 1.1 200 OK

{

"code" :0,

"message":"ok",

"client_id":"pay_test",

"order_no":"pay_test2023118164578",

"token":"170202154314200189",

"tid":"tpay_test-202312082315563",

"status_code":5

}

Response (failure)

HTTP 1.1 401 Unauthorized

{

"code": 998,

"message": "Authentication token is missing or incorrect"

}

In case of success

| Parameter | Type | Description |

|---|---|---|

| code | string | Result |

| message | string | Message |

| client_id | string | Client ID |

| order_no | string | Order Number |

| token | string | Payment Token |

| tid | string | Unique Payment Number |

| status_code | number | Payment status code ( 1.Create payment, 2.Entering payment (Open the payletter payment process page), 3.Payment progress , 4.Payment failure , 5.Payment success) In case of a virtual accounts, when status_code=4, the transaction remains pending deposit until the expire_date, and is marked as failed after the expire_date. |

In case of failure

| Parameter | Type | Description |

|---|---|---|

| code | number | Error code |

| message | string | Error Message |

Transaction History Confirmation

Request

GET /v1.0/receipt/info/tsktest1-202201039368273/?client_id=sktest1 HTTP/1.1

Host: testpgapi.payletter.com

Authorization: PLKEY NDhBNDJGNUY0QzI5RjY5NjAwMDdDREI0Q0Q4RDVGOTY=

Key Type

SEARCH

HTTP Request

GET v1.0/receipt/info/{tid}

Request Parameters

| Parameter | Default | Type | Size | Description |

|---|---|---|---|---|

| client_id | Necessary | string | 20 | Store ID |

Response Parameters

Response (Success)

HTTP 1.1 200 OK

{

"receipt_url" :"https://testpg.payletter.com/PGSVC/AllTheGate/Receipt_All.asp?id=72720c6d230e662b|001|4|3230323230313230313435393434343037383664613733393939b3a96f05b2f37aea1b64c823d9cc57767510d8e0e351a4c1635cefc354af7e2a0418a9ffce0c8ecac4b7c28ceefb3a905d82ee1dcab6b3d4bc18393cb5547ba9eec2b92fe4"

}

Response (failure)

HTTP 1.1 401 Unauthorized

{

"code": 998,

"message": "Authentication token is missing or incorrect"

}

In case of success

| Parameter | Type | Description |

|---|---|---|

| receipt_url | string | Transaction History Confirmation URL |

In case of failure

| Parameter | Type | Description |

|---|---|---|

| code | number | Error Code |

| message | string | Error Message |

Error Code

Success or failure for API request can be checked by HTTP StatusCode

In case of StatusCode 200 OK, request is in success. Except for this case, please refer to following StatusCode

Table of Error code

| HTTP Response | Error Code | Error Message | Description |

|---|---|---|---|

| 400 | 997 | Various error message. | Invalid request (request parameter verification required) |

| 401 | 998 | Authentication token is missing or incorrect. | Authentication Error |

| 403 | 993 | Yon do not have authorization. | Authentication Error |

| 405 | 995 | Not authorized method. | Method error such as POST / GET and etc |

| 406 | 2000 ~ 5000 | Various error message | Error occurred in business logic processing |

| 500 | 999 | Internal server error | System Error |

Appendix

Table of PGCode

| PGCode | Note |

|---|---|

| creditcard | Credit Card |

| banktransfer | Internet Banking (Korea Financial Telecommunications & Clearings Institute) |

| virtualaccount | Virtual Account |

| mobile | Mobile Payment |

| book | Book Voucher |

| voucher | Voucher |

| culture | Culture Voucher |

| smartculture | Smart Culture Voucher |

| teencash | Teen Cash |

| tmoney | Transportation Card |

| cvs | CVS Cash |

| eggmoney | Eggmoney |

| phonebill | Phonebill |

| cashbee | EZL |

| kakaopay | Kakaopay |

| payco | Payco |

| checkpay | Checkpay |

| toss | Toss |

| ssgpay | SSGPAY |

| naverpay | Naver Pay |

| samsungpay | SamsungPay |

| applepay | applepay |

Table of CardCode

| Card Code | Namd of Cardcompany |

|---|---|

| P001 | 비씨(페이북) (BC Paybook) |

| P002 | KB Pay(국민) (Kookmin) |

| P003 | 하나 (Hana) |

| P004 | 삼성 (Samsung) |

| P005 | 신한 (Shinhan) |

| P006 | 현대 (Hyundai) |

| P007 | 롯데 (Lotte) |

| P008 | NH (Nonghyup) |

| P009 | 씨티(구.한미) (City) |

| P011 | 우리 (Woori) |

| P012 | 신협 (ShinHyup) |

| P013 | 광주 (Kwangju) |

| P014 | 전북 (JeonBuk) |

| P015 | 제주 (Jeju) |

| P016 | 우체국 (Post) |

| P017 | MG 새마을금고 (MG Community Credit Cooperatives) |

| P018 | 저축은행 (Saving Bank) |

| P019 | 카카오뱅크 (Kakao Bank) |

App-Schema sample source

| OS | Sample Source |

|---|---|

| Android | Download |

| iOS | Download |