Payletter Overseas Payment Service

Introduction

No matter how many times you think, Payletter is your partner at all times!

Payletter provides an electronic payment service for sales of product at online store.

We are trying our best to provide the most convenient payment service with our capability in stable transaction

processing, various kinds of payment method and security certification.

| 1. Possession of multiple payment methods that can cover the entire global market, including Southeast Asia, the Americas, and Europe |

| 2. Stable payment environment based on PCI-DSS(Global Credit Card data security standard, ISMS (Data security standard certificated in local organization) |

| 3. Proven capability in transaction processing from experience in working with local No.1 e-commerce, music streaming and VOD service |

| 4. Stable service and settlement in basis of solid financial structure |

| 5. Prompt response for merchants and customers’ inquirires |

Payment Method and Additional Service

| Credit/Debit Cards | E-wallets | Prepaid cards | Convenience store payment | Mobile Payment |

|---|---|---|---|---|

| Visa Master JCB Amex UnionPay |

PayPal Alipay WechatPay Razer Gold Wallet Line Pay PayPay |

Paysafecard Cherry Credits Webmoney Bitcash Netcash |

7eleven Alfamart Indomaret Konbini |

Maxis Etisalat Zain Ooredoo Carrier Billing for Japan |

*For additional inquiries about payment methods, please contact us separately.

How to Apply

| Partnership Inquiry : globalpg@payletter.com |

|---|

| 1. Apply for Payletter Service Online |

| 2. Service Review |

| 3. Submission of contract and required documents |

| 4. Screening of each payment methods - Credit card: It takes about 2 weeks - Other payment methods: It takes about 1 month |

| 5. Sign up completed |

Required Document

| Division | Corporate Business | Individual Business |

|---|---|---|

| Contract Document | 1. Copies of Global PayoneQ Service Agreement | |

| Required Documents | 1. 1 Copy of Certificate of Business 2. 1 Original Certificate of Seal Impression (Corporate) 3. 1 Copy of Certificate of Usesignet (If you stamped the usesignet) 4. 1 Original Certified Copy of the Registry 5. 1 Copy of Bankbook (Under the corporate name) 6. The document that you checked in [Appendix 5] of Agreement |

1. 1 Copy of Certificate of Business 2. 1 Original Certificate of Seal Impression (Individual) 3. 1 Copy of Representative ID 4. 1 Copy of Bankbook (Under the representative name) |

Integration preparation

| Information to be provided by Store | Description |

|---|---|

| Notification URL | Notification URL for payment to be received as backend It is available to reach the Notification URL through only 80,443 port on test environment So it is required to register firewall if you want to use other ports. Please send us your IP and Port to the following email. gpoqdev@payletter.com |

| IP | Store’s Request IP when you integrate an private access API |

| Information to be provided by the Payletter | Description |

|---|---|

| StoreID | StoreID provided after contract with Payletter |

| API Key | API Key provided after contract with Payletter |

API HTTPS Protocol

Payletter API HTTPS supports TLS 1.2 or higher.

Firewall

Please add inbound IP in order to receive a notification for payment completion.

Test : 211.115.120.167

Live : 211.115.72.37, 211.115.72.38, 211.115.120.37, 211.115.120.38

API Authorization

API Key will be issued once contract is completed.

Please send API Key for HttpRequestHeader authorization as follows.

Authorization: GPLKEY {store_apikey}

API Endpoint URL

| Environment | URL |

|---|---|

| Test | https://dev-api.payletter.com |

| Live | https://api.payletter.com |

Store Information for Test Environment

Integration test is available with registered StoreID and API Key in test environment.

Test payment is only available with PLCreditcard(non-certified) and PayPalExpressCheckout.

| StoreID | PL_Merchant |

| API KEY | PL_Merchant |

[Payment Test]

Test payment can be made in our test environment. Please refer to following information for your test.

1. Credit card payment is only available with a card issued overseas basically. We do not provide test cards.

2. If you need a test for credit card(PLCreditcardMpi) or UnionPay, please contact us separately.

3. A test for credit card(PLCreditcard) is available with random numbers. Please refer to following steps.

1) Please enter credit card number like below.

- Visa: Random number starting with 4

- Master: Random number starting with 51

- JCB: Random number starting with 35

- Amex: Random number starting with 34

2) Please enter Expiry date and CVV number randomly.

4. PayPal test is available with your PayPal account in sandbox server.

Options by payment method

| Payment Method | Recurring Payment | Cancellation | Partial Cancellation | Cancellation Period |

|---|---|---|---|---|

| Credit card(VISA, Master, JCB) | O | O | O | D+180 |

| Credit card(Amex) | O | O | O | D+180 |

| UnionPay | X | O | O | D+730 |

| PayPal | O | O | O | D+180 |

| WeChatPay (H5/QR) | X | O | O | D+365 |

| Alipay | X | O | O | D+365 |

| Alipay+ | X | O | O | D+365 |

| LoadCentral | X | X | X | cannot be canceled |

| FPX | X | X | X | cannot be canceled |

| Maybank2U | X | X | X | cannot be canceled |

| AIS 12 Call | X | X | X | cannot be canceled |

| True Money | X | X | X | cannot be canceled |

| Razer Gold PIN | X | X | X | cannot be canceled |

| Razer Gold Wallet | X | X | X | cannot be canceled |

| Gcash | X | X | X | cannot be canceled |

| 7eleven | X | X | X | cannot be canceled |

| Alfamart | X | X | X | cannot be canceled |

| Indomaret | X | X | X | cannot be canceled |

| Bank transfer (Indonesia) | X | X | X | cannot be canceled |

| Doku wallet | X | X | X | cannot be canceled |

| Maxis | X | X | X | cannot be canceled |

| Fawry | X | X | X | cannot be canceled |

| Etisalat | X | X | X | cannot be canceled |

| Zain | X | X | X | cannot be canceled |

| Ooredoo | X | X | X | cannot be canceled |

| Bank Transfer (Vietnam) | X | O | X | D+150 |

| VTCPay | X | O | X | D+180 |

| Cherry Credits | X | X | X | cannot be canceled |

| Chunghwa Tel | X | X | X | cannot be canceled |

| CreditCard (Taiwan) | X | X | X | cannot be canceled |

| Fareastone | X | X | X | cannot be canceled |

| JKO Pay | X | X | X | cannot be canceled |

| Line Pay | X | X | X | cannot be canceled |

| BitCash | X | O | X | D+180 |

| Konbini | X | X | X | cannot be canceled |

| NetCash | X | O | X | D+180 |

| PayEasy | X | X | X | cannot be canceled |

| PayPay | X | O | O | D+365 |

| ApplePay | X | X | X | cannot be canceled |

| Ewallet | X | X | X | cannot be canceled |

| GAMAPay | X | X | X | cannot be canceled |

| GooglePay | X | X | X | cannot be canceled |

| Smartpay | X | X | X | cannot be canceled |

| Webatm | X | X | X | cannot be canceled |

| AlipayCN | O | O | O | D+365 |

Technical Support

gpoqdev@payletter.com

For quick response, please provide detailed information such as integration environment, Store ID, invoice number,

time of transaction, token and related others. It would be useful for support.

Overseas Payment API

List of API

As allowed IPs are available to access for Private API,

please send your request IP to the person in charge of contract.

| URL | METHOD | ACCESS | DESCRIPTION |

|---|---|---|---|

| api/payment/request | POST | Public | Payment Request |

| payment/recurring | POST | Private | Payment request after the first recurring payment |

| payment/refund | POST | Public | Payment Cancellation/Partial Cancellation |

| settlement/detailslist | POST | Private | Settlement Details Inquire |

| paypal/subscription/cancel | POST | Public | PayPal Recurring Payment(Subscription) Cancellation |

| receipt/info/{paytoken} | GET | Public | Transaction history confirmation |

| payment/transaction/list | POST | Private | Daily Payment Details Inquiry |

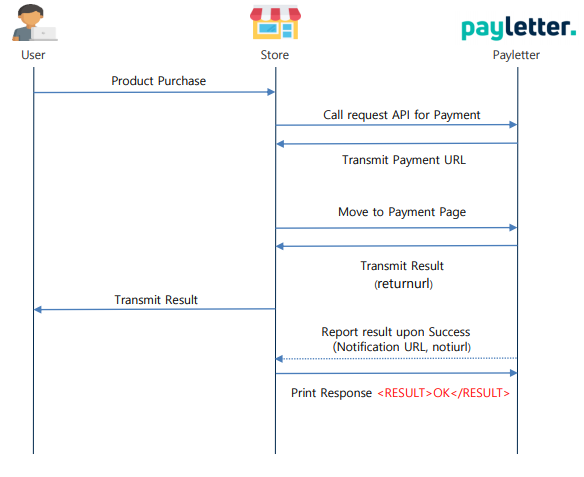

Payment Process

API Sample Source

The available programming languages for API sample sources of PAYLETTER are ASP, ASP.NET, JSP, PHP.

| Programming Language | Sample Source |

|---|---|

| ASP | Download |

| ASP.NET | Download |

| JSP | Download |

| PHP | Download |

Payment Request

Request

POST api/payment/request HTTP/1.1

Host: dev-api.payletter.com

Authorization: GPLKEY PL_Merchant

Content-Type: application/json

{

"storeid" : "PL_Merchant",

"currency" : "USD",

"storeorderno" : "123456789",

"amount":1.00,

"payerid":"tester",

"payeremail":"tester@test.com",

"returnurl":"https://merchant.test.com/Return.aspx",

"notiurl":"https://merchant.test.com/PaymentNoti.aspx",

"pginfo":"PLCreditCard"

}

Access Authority

Public

HTTP Request

POST api/payment/request

Request json data

| Division | Parameter | Type | Size | M/O | Description |

|---|---|---|---|---|---|

| Common | storeid | string | 20 | M | Store ID |

| currency | string | 3 | M | Currency code (ISO 4217) Ex) USD, JPY (Not required if pinflag = Y) |

|

| storeorderno | string | 128 | M | Store Order Number | |

| amount | number | M | Payment amount (remove thousands sign) *All the currencies may include up to the second decimal place, except KRW, JPY, VND. *KRW, JPY, VND should not include any decimal place. (Not required if pinflag = Y) |

||

| payerid | string | 50 | M | Store payer (member) ID (E-mail, English and numeric characters are available) |

|

| payeremail | string | 50 | M | Store payer (member) email | |

| returnurl | string | 256 | M | Web page URL to connect after completing the payment | |

| notiurl | string | 256 | O | Notification URL to receive successful payment result | |

| servicename | string | 100 | O | Store service name Required if WechatPay, AlipayPlus(Size 50 if KSNET_Alipay), Codapay ,PayPalExpressCheckout & recurringtype=Y |

|

| pginfo | string | 40 | O | Payment request PG information (PG Code Table) (Required for Directpay type) |

|

| payinfo | string | 200 | O | Additional payment information | |

| pinflag | string | 1 | O | For zGold-MOLPoints Direct Top Up, set to Y | |

| recurringtype | string | 1 | O | Whether to use recurring payment or not (Y: use, N: not use) | |

| baflag | string | 1 | O | Recurring Payment First Payment 0 amount Request (Y: use, N: not use) Available when recurringtype = Y Ex):When recurringtype = Y and baflag = Y, currency is required, amount = 0 (※Supported payment methods: AlipayKKAlipayCN, DirectPay not supported) |

|

| custom | string | 2000 | O | Random value sent by store After setting customer information, order information, and other necessary information return to the payment result ( This value cannot contain any of the following characters: | ' ) |

|

| Creditcard Authentication |

billaddrcity | string | 64 | O | the card billing address city |

| billaddrcountry | string | 3 | O | card billing address country (ISO 3166-1 numeric three-digit country code) Ex) 410 (Korea), 840 (USA) |

|

| billaddrline1 | string | 50 | O | the card billing address | |

| billaddrpostcode | string | 16 | O | card billing address zip code | |

| PayPal Common |

paypalisppflag | string | 1 | O | Set to ”Y” when using PayPal ISPP (If paypalisppflag=Y, payerfirstname, payerlastname, payerphone, payercountrycode, payercreatedate required data) |

| payerfirstname | string | 50 | O | payer first name | |

| payerlastname | string | 50 | O | payer last name | |

| payerphone | string | 20 | O | Payer phone number (national notation) Ex) (042) 1123 4567) |

|

| payercreatedate | string | 30 | O | Payer join day (ISO 8601 date format) Ex) 2023-04-09T19:14:55.277-0:00 |

|

| payercountrycode | string | 2 | O | Ipayer country code (ISO Alpha-2 Country Code) Ex) AU, KR |

|

| paypalcnlurlflag | string | 1 | O | Whether to use returnurl in PayPal payment cancellation page ( Y : use, N : not use ) (If opened as a popup, it will close) (If the page is a type of moving, it will connect to returnurl) |

|

| PayPal Recurring Payment(Subscription) |

intervaltype | string | 1 | O | PayPal subscription billing cycle (1: DAY, 2: WEEK, 3: MONTH, 4: YEAR) (Required if PayPalExpressCheckout & recurringtype=Y) |

| intervalcnt | string | 3 | O | PayPal subscription billing interval (DAY: 1~365, WEEK: 1~52, MONTH: 1~12, YEAR: 1) (Required if PayPalExpressCheckout & recurringtype=Y) |

|

| totalcycles | string | 3 | O | Number of PayPal subscription charges (2-999, Unlimited: 0) (Required if PayPalExpressCheckout & recurringtype=Y) |

|

| PayPal Recurring Payment(Billing) |

paypalrecurrflag | string | 1 | O | Whether to use paypal recurring payment(billing) or not (Y: use, N: not use) (if paypalrecurrflag= "Y", recurringtype = "Y" need) |

[PayPal Recurring Payment]

| Division | Description | Required Parameter | Note |

|---|---|---|---|

| Common |

Request payment with recurringtype = "Y" to use PayPal Recurring Payment |

recurringtype = "Y" | |

| PayPal Recurring Payment (Subscription) |

1. Request recurring payment (subscription) with PayPal billing information |

recurringtype = "Y" intervaltype intervalcnt totalcycles |

|

| PayPal Recurring Payment (Billing) |

1. Request recurring payment (Billing) |

recurringtype = "Y" paypalrecurrflag = "Y" |

|

| PayPal Recurring Payment (Billing) with no amount |

1. Request recurring payment (Billing) (do not forward the amount and currency values) |

recurringtype = "Y" paypalrecurrflag = "Y" |

Supports DirectPay only |

Response json Data

In case of success

HTTP 1.1 200 OK

{

"token" : 167702306200001,

"online_url": "https://devgpgclient.payletter.com/hub.aspx?location=online&token=167702306200001",

"mobile_url": "https://devgpgclient.payletter.com/hub.aspx?location=mobile&token=167702306200001"

}

In case of failure

HTTP 1.1 400 BadRequest

{

"error": {

"code": 997,

"message": "The request is invalid.",

"detail": "[2102]Not exist PG contract information",

"plcode": 997

}

}

In case of success

| Parameter | Type | Description |

|---|---|---|

| token | number | Payment Authentication Token |

| online_url | string | Payment Page Call URL in PC For payment methods that only support the mobile environment, pass an empty value (WechatpayH5Payment) |

| mobile_url | string | Payment Page Call URL in Mobile For payment methods that only support the pc environment, pass an empty value (WechatpayQRCodePayment) |

In case of failure

| Parameter | Type | Description |

|---|---|---|

| error | object | |

| └ code | number | Error Code |

| └ message | string | Error Message |

| └ detail | string | Error Detail Message |

| └ plcode | number | Other error codes |

Payment Integration

Please call payment page using URL returned to payment request API Response.

Once user proceeds with payment, payment result will be returned to returnurl transmitted by payment request.

We recommend to process payment completion (store's business logic, such as payment of goods) in notiurl.

or notification URL of the store registered in advance.

Please refer to following instruction on process of returnurl and notiurl.

Result Processing (returnurl)

Payment result is transmitted to POST parameter in Request.

For payment methods that do not immediately transact, such as bank transfer and cvs

the success or failure of the payment authentication request is returned.

Therefore, you should not process purchases in returnurl.

| Parameter | Type | Description |

|---|---|---|

| retcode | string | code (0=success 0<>failure) |

| retmsg | string | message |

| storeid | string | Store ID |

| storeorderno | string | Store Order Number |

| payamt | number | Amount of payment |

| custom | string | Random value sent by store |

| pginfo | string | Paid PG information |

Payment Processing (Notification URL, notiurl)

The successful payment result is delivered as POST as shown below.

storeid=PL_Merchant&countrycode=KOR¤cy=USD&storeorderno=1763358046&payamt=1

&payerid=payletter&payeremail=gpltest@payletter.com&servicename=Payletter+Service&custom=Payletter Custom&payinfo=Payletter Info

&pginfo=PLCreditCard×tamp=1763390574&hash=a93806f7674253362a4f58a316fe740a2da9ae733013083648a7a48c2dc6f79f

¬ifytype=1&paytoken=20251117WUHZ7AZ6FY0H&trantime=2025-11-17 14:42:46&retcode=0&retmsg=&poqtoken=&cardkind=테스트카드

&cardno=************1561&pgtoken=8268867&cid=8268867¬ifyid=290050

| Parameter | Type | Description |

|---|---|---|

| notifyid | number | Notification unique identification number |

| notifytype | number | Notification type 1: Successful payment (Processing store purchase) 2: Cancellation (Processing cancellation of purchases from store) 3: Chargeback (Processing cancellation of purchases from store) 4: Partial cancellation (Processing Partial cancellation of purchases from store) 5: PayPal Subscription Create (Processing store PayPal subscription create) 6: PayPal Pending (Processing store PayPal payment pending status) 7: Recurring payment first payment 0 amount token create(Recurring payment token create) 8: Recurring payment first payment 0 amount token cancel(Recurring payment token cancel) |

| storeid | string | Store ID |

| countrycode | string | Country code |

| currency | string | Currency code |

| storeorderno | string | Store Order Number (In case of PayPal subscription transaction, a randomly generated value is transmitted) |

| paytoken | string | Payletter payment unique number |

| payamt | number | Amount of payment |

| pginfo | string | Paid PG information |

| payerid | string | Store payer (member) ID |

| payeremail | string | Store payer (member) email |

| servicename | string | Store service name |

| custom | string | Random value sent by store |

| payinfo | string | Additional payment information |

| timestamp | number | Unix time stamp |

| hash | string | SHA256 hash value for parameter verification SHA256(storeid + currency + storeorderno + payamt + payerid + timestamp +API Key) For the recurring payment first payment 0 amount : SHA256(storeid + storeorderno + payerid + timestamp +API Key) |

| trantime | string | Payletter payment time (yyyy-MM-dd HH:mm:ss) |

| poqtoken | string | Payletter recurring payment token (forward if recurringtype = Y) |

| cardkind | string | Card name (Transfer in case of PLCreditCard, PLCreditCardMpi, PLCreditCard_CY_) |

| cardno | string | Card number (only the last 4 digits are transmitted and the rest is masked) (Transfer in case of PLCreditCard, PLCreditCardMpi, PLCreditCard_CY_) |

| pgtoken | string | PG transaction number |

| cid | string | Card approval number(PLCreditCard, PLCreditCardMpi, PLUnionPay) |

| intervaltype | number | PayPal subscription billing cycle (1: DAY, 2: WEEK, 3: MONTH, 4: YEAR) (Forward if notifytype = 5) |

| intervalcnt | number | PayPal subscription billing interval (DAY: 1~365, WEEK: 1~52, MONTH: 1~12, YEAR: 1) (Forward if notifytype = 5) |

| totalcycles | number | Number of PayPal subscription charges (2~999, unlimited: 0) (Forward if notifytype = 5) |

| retcode | number | Result code (0 fixed) |

| retmsg | string | Result message (fixed empty value) |

Receives the result value and executes the business logic of the Store, such as payment of goods suitable for the Store.

After completion of processing in Notification URL, please print the following string if successful.

<RESULT>OK</RESULT>

Otherwise, the notification is considered failed and resent every 5 minutes up to 10 times. (Basic 10 times, adjustable)

On success, ensure that no html and other code other than <RESULT>OK</RESULT> is exposed on the page.

To prevent forgery/falsification of the delivered result value, create a sha256 hash value and then compare and

verify the delivered hash parameter.

In addition to payment success, notification for processing completion such as cancellation/partial cancellation

and chargeback are also sent, so the store's business logic should be executed according to the notifytype parameter.

Notification delivery history can be checked in the Sales Mgmt > Notify List menu on the Store manager site..

Payment request after the first Recurring payment

The first recurring payment is requested by setting the recurringtype parameter of the Payment Request API (api/payment/request) to Y.

When the payment for this request is successful, the recurring payment request is completed. From the second payment request, payment/recurring API can be used.

(In the case of PayPal, from the second payment request, PayPal creates a payment according to the billing conditions,

and if successful, it delivers the result to Payletter, and Payletter sends a payment success notice to the store.)

Request

POST payment/recurring HTTP/1.1

Host: dev-api.payletter.com

Authorization: GPLKEY PL_Merchant

Content-Type: application/json

{

"storeid" : "PL_Merchant",

"poqtoken":"TPL_Merchant20230509235776",

"storeorderno":"123456789",

"currency":"USD",

"amount":1.00,

"pginfo":"PLCreditCard"

}

Access Authority

Private

HTTP Request

POST payment/recurring

Request json data

| Division | Parameter | Type | Size | M/O | Description |

|---|---|---|---|---|---|

| Division | storeid | string | 20 | M | Store ID |

| poqtoken | string | 40 | M | Payletter Recurring payment token received at the time of the first recurring payment | |

| storeorderno | string | 128 | M | Store Order Number | |

| currency | string | 3 | M | Currency code (ISO 4217) Ex) USD, JPY | |

| amount | number | M | Payment amount (remove thousands sign) *All the currencies may include up to the second decimal place, except KRW, JPY, VND. *KRW, JPY, VND should not include any decimal place. |

||

| pginfo | string | 40 | M | Payment request PG information(PG Code Table) | |

| payinfo | string | 200 | O | Additional payment information | |

| payerid | string | 50 | O | Store payer (member) ID | |

| custom | string | 2000 | O | Random value sent by store | |

| servicename | string | 100 | O | Store service name | |

| PayPal Recurring Payment (Billing) |

paypalisppflag | string | 1 | O | Set to ”Y” when using PayPal ISPP (If paypalisppflag=Y, payerfirstname, payerlastname, payerphone, payercountrycode, payercreatedate required data) |

| payerfirstname | string | 50 | O | payer first name | |

| payerlastname | string | 50 | O | payer last name | |

| payerphone | string | 20 | O | Payer phone number (national notation) Ex) (042) 1123 4567) |

|

| payercreatedate | string | 30 | O | Payer join day (ISO 8601 date format) Ex) 2023-04-09T19:14:55.277-0:00 |

|

| payercountrycode | string | 2 | O | Ipayer country code (ISO Alpha-2 Country Code) Ex) AU, KR |

Response json Data

In case of success

HTTP 1.1 200 OK

{

"data" : {

"storeid" :"PL_Merchant",

"countrycode":"KOR",

"storeorderno":"123456789",

"amount":1.00,

"payerid":"testid",

"poqtoken":"TPL_Merchant20230509235776",

"paytoken":"20251117O86M6MG7ETE4",

"paydate":"2025-11-17 15:10:28",

"pgtoken":"8269266",

"cid":"8269267"

}

}

In case of failure

HTTP 1.1 400 BadRequest

{

"error": {

"code": 997,

"message": "The request is invalid.",

"detail": "Request failed.Check the customer's payment information again",

"plcode": 997

}

}

In case of success

| Parameter | Type | Description |

|---|---|---|

| data | object | |

| └ storeid | string | Store ID |

| └ countrycode | string | Country code |

| └ storeorderno | string | Store Order Number |

| └ amount | number | Amount of payment |

| └ payerid | string | Store payer (member) ID |

| └ poqtoken | string | Payletter recurring payment token |

| └ paytoken | string | Payletter payment unique number |

| └ paydate | string | Payletter payment time (yyyy-MM-dd HH:mm:ss) |

| └ pgtoken | string | PG transaction number |

| └ cid | string | Card approval number(PLCreditCard, PLCreditCardMpi, PLUnionPay) |

In case of failure

| Parameter | Type | Description |

|---|---|---|

| error | object | |

| └ code | number | Error Code |

| └ message | string | Error Message |

| └ detail | string | Error Detail Message |

| └ plcode | number | Other error codes |

Payment Refund

Request

POST payment/refund HTTP/1.1

Host: dev-api.payletter.com

Authorization: GPLKEY PL_Merchant

Content-Type: application/json

{

"storeid" : "PL_Merchant",

"paytoken":"202511172VUASYL4H68J",

"currency":"USD",

"amount":1.00

}

Access Authority

Public

HTTP Request

POST payment/refund

Request json data

| Parameter | Type | Size | M/O | Description |

|---|---|---|---|---|

| storeid | string | 20 | M | Store ID |

| paytoken | string | 20 | M | Payletter payment unique number of the payment to be canceled |

| currency | string | 3 | M | Currency code (ISO 4217) Ex) USD, JPY |

| amount | number | M | Cancellation amount (thousands sign removed) *All the currencies may include up to the second decimal place, except KRW, JPY, VND. *KRW, JPY, VND should not include any decimal place. |

|

| pginfo | string | 40 | O | PG information of the payment request for cancellation (PG Code Table) |

Response json data

In case of success

HTTP 1.1 200 OK

{

"data" : {

"storeid" :"PL_Merchant",

"paytoken":"202511172VUASYL4H68J",

"pginfo":"PLCreditCard",

"storeorderno":"123456789",

"currency":"USD",

"amount":1.00,

"refunddate":"2025-11-17 15:14:19",

"pgtoken":"8269266",

"cid":"8269267"

}

}

In case of failure

HTTP 1.1 400 BadRequest

{

"error": {

"code": 997,

"message": "The request is invalid.",

"detail": "[2104]The payment transaction does not exist",

"plcode": 997

}

}

In case of success

| Parameter | Type | Description |

|---|---|---|

| data | object | |

| └ storeid | string | Store ID |

| └ paytoken | string | Payletter payment unique number |

| └ pginfo | string | PG information |

| └ storeorderno | string | Store Order Number |

| └ currency | string | Currency code |

| └ amount | number | Cancellation amount |

| └ refunddate | string | Payletter Payment Cancellation Time (yyyy-MM-dd HH:mm:ss) (For VTCDomesticBank and VTCPay, the cancellation request time is delivered, not the payment canceled time, and a cancellation notice (notifytype=2) is delivered when cancellation is completed later) |

| └ pgtoken | string | PG transaction number |

| └ cid | string | Card approval number(PLCreditCard, PLCreditCardMpi, PLUnionPay) |

In case of failure

| Parameter | Type | Description |

|---|---|---|

| error | object | |

| └ code | number | Error Code |

| └ message | string | Error Message |

| └ detail | string | Error Detail Message |

| └ plcode | number | Other error codes |

Settlement Details Inquiry

Request

POST settlement/detailslist HTTP/1.1

Host: dev-api.payletter.com

Authorization: GPLKEY PL_Merchant

Content-Type: application/json

{

"storeid" : "PL_Merchant",

"currencytype":1,

"searchtype": 1,

"settlestate": 0,

"settlesymd":"20230509",

"settleeymd":"20230510"

}

Access Authority

Private

HTTP Request

POST settlement/detailslist

Request json data

| Parameter | Type | Size | M/O | Description |

|---|---|---|---|---|

| storeid | string | 20 | M | Store ID |

| pgcode | string | 20 | O | PG Code (PG Code Table) |

| pgsubcode | string | 20 | O | PG Sub Code (PG Code Table) |

| currencytype | number | M | Currency type (1: Payment currency, 2: Settlement currency) ※ if ymdtype != 2 Applied | |

| searchtype | number | M | Settlement type (1: by payment method, 2: by details) ※ if ymdtype != 2 Applied | |

| settlestate | number | O | Settlement status (fixed value : 0) | |

| settlesymd | string | 8 | M | Settlement start date (yyyyMMdd) if ymdtype = 2 Approval start date |

| settleeymd | string | 8 | M | Settlement end date (yyyyMMdd) if ymdtype = 2 Approval end date |

| ymdtype | number | 1 | O | Date distinction (2: based on approval date, other: based on existing settlement date) |

| paytoken | string | 20 | O | PayToken (used only if ymdtype=2) |

Response json data

In case of success

HTTP 1.1 200 OK

{

"data" : {

"datalist": [

{

"storeid": "PL_Merchant",

"settleymd": "20230131",

"pgcode": "PL",

"pgsubcode": "CreditCardMpi",

"currency": "",

"settlestate": 1,

"paycnt": 1,

"payamt": 0,

"settleamt": -414.0,

"totalfee": 0,

"vat": 0,

"supplyamt": 0,

"storefee": 0,

"transactionfee": 0,

"chargebackfee": 0,

"refundfee":0,

"etcfee": 0,

"note": "20230131 testtest",

"notedesc": "",

"rollingreserve": -414.0,

"paytoken": ""

},

{

"storeid": "PL_Merchant",

"settleymd": "20230131",

"pgcode": "PL",

"pgsubcode": "CreditCard",

"currency": "USD",

"settlestate": 1,

"paycnt": 1,

"payamt": 79.99,

"settleamt": 73.94,

"totalfee": 6.05,

"vat": 0.55,

"supplyamt": 5.5,

"storefee": 5.0,

"transactionfee": 0.5,

"chargebackfee": 0,

"refundfee":0,

"etcfee": 0,

"note": "4.00",

"notedesc": "",

"rollingreserve": "",

"paytoken": "20221218TN79J9V1YBSV"

}

]

}

}

In case of failure

HTTP 1.1 403 Forbidden

{

"error": {

"code": 993,

"message": "You do not have authorization.",

"detail": "Not allowed ip address.",

"plcode": 993

}

}

In case of success

| Parameter | Type | Description |

|---|---|---|

| data | object | |

| └ datalist | json array | Settlement Data |

| └ storeid | string | Store ID |

| └ settleymd | string | Settlement Date |

| └ pgcode | string | PG Code |

| └ pgsubcode | string | PG Sub Code |

| └ currency | string | Currency code |

| └ settlestate | number | Settlement status (1: Settlement, 2: Settlement scheduled) |

| └ paycnt | number | Number of payments |

| └ payamt | number | Amount of payment |

| └ settleamt | number | Settlement amount |

| └ totalfee | number | Total fee |

| └ vat | number | VAT |

| └ supplyamt | number | supply value |

| └ storefee | number | Store Fee |

| └ transactionfee | number | Transaction Fee |

| └ chargebackfee | number | Chargeback Fee |

| └ refundfee | number | Refund Fee |

| └ etcfee | number | other Fees |

| └ note | string | Remarks (fee rate or reference) |

| └ notedesc | string | Remark details (fee rate or reference) |

| └ rollingreserve | string | RollingReserve |

| └ paytoken | string | Payletter payment unique number |

| └ txymd | string | Approval date (responds only if ymdtype=2) |

In case of failure

| Parameter | Type | Description |

|---|---|---|

| error | object | |

| └ code | number | Error Code |

| └ message | string | Error Message |

| └ detail | string | Error Detail Message |

| └ plcode | number | Other error codes |

PayPal Recurring Payment(Subscription) Cancel Request

Request

POST paypal/subscription/cancel HTTP/1.1

Host: dev-api.payletter.com

Authorization: GPLKEY PL_Merchant

Content-Type: application/json

{

"storeid" : "PL_Merchant",

"poqtoken":"TPL_Merchant20230509235776"

}

Access Authority

Public

HTTP Request

POST paypal/subscription/cancel

Request json data

| Parameter | Type | Size | M/O | Description |

|---|---|---|---|---|

| storeid | string | 20 | M | Store ID |

| poqtoken | string | 40 | M | Payletter recurring payment token |

Response json data

In case of success

HTTP 1.1 200 OK

{

"data" : {

"code" :0,

"message":"OK"

}

}

In case of failure

HTTP 1.1 400 BadRequest

{

"error": {

"code": 997,

"message": "The request is invalid.",

"detail": "[2235]This PayPal subscription information has already been canceled ",

"plcode": 997

}

}

In case of success

| Parameter | Type | Description |

|---|---|---|

| data | object | |

| └ code | number | Response Code |

| └ message | string | Response Message |

In case of failure

| Parameter | Type | Description |

|---|---|---|

| error | object | |

| └ code | number | Error Code |

| └ message | string | Error Message |

| └ detail | string | Error Detail Message |

| └ plcode | number | Other error codes |

Transaction history confirmation

Request

GET receipt/info/2024062771EFO2U4ZCKF?storeid=PL_Merchant HTTP/1.1

Host: dev-api.payletter.com

Authorization: GPLKEY PL_Merchant

Access Authority

Public

HTTP Request

GET receipt/info/{paytoken}

Request data

| Parameter | Type | Size | M/O | Description |

|---|---|---|---|---|

| storeid | string | 20 | M | Store ID |

Response json data

In case of success

HTTP 1.1 200 OK

{

"receipt_url" : {

"https://dev-api.payletter.com/receipt/info/2024062771EFO2U4ZCKF?storeid=PL_Merchant"

}

In case of failure

HTTP 1.1 400 BadRequest

{

"error": {

"code": 997,

"message": "The request is invalid.",

"detail": "The payment does not exist.",

"plcode": 997

}

}

In case of success

| Parameter | Type | Description |

|---|---|---|

| receipt_url | string | Transaction history confirmation URL |

In case of failure

| Parameter | Type | Description |

|---|---|---|

| error | object | |

| └ code | number | Error Code |

| └ message | string | Error Message |

| └ detail | string | Error Detail Message |

| └ plcode | number | Other error codes |

Daily Payment Details Inquiry

Request

POST payment/transaction/list HTTP/1.1

Host: dev-api.payletter.com

Authorization: GPLKEY PL_Merchant

Content-Type: application/json

{

"storeid" : "PL_Merchant",

"currency":"USD",

"date":"20240821",

"searchtype": 0

}

Access Authority

Private

HTTP Request

POST payment/transaction/list

Request json data

| Parameter | Type | Size | M/O | Description |

|---|---|---|---|---|

| storeid | string | 20 | M | Store ID |

| pgcode | string | 20 | O | PG Code (PG Code Table) |

| pgsubcode | string | 20 | O | PG Sub Code (PG Code Table) |

| currency | string | 3 | O | Currency code (ISO 4217) Ex) USD, JPY |

| date | string | 8 | M | Search date (yyyyMMdd) |

| searchtype | number | M | Inquiry criteria 0: All 1: Payment (based on payment date) 2: Cancellation (based on cancellation date) 3: Partial cancellation (based on cancellation date) |

|

| paytoken | string | 20 | O | Payletter payment unique number |

Response json data

In case of success

HTTP 1.1 200 OK

{

"data" : {

"rowcount": {

"total": 2,

"success": 2,

"cacnel": 0

},

"datalist": [

{

"paytoken": "20240821HCH95D17M6PT",

"pginfo": "PLCreditCard",

"storeorderno": "bb1bbfdc-871c",

"payerid": "test123",

"amount": 1.00,

"currency": "USD",

"state": 1,

"ymd": "20240821",

"regdate": "2024-08-21 12:13:49",

"cnldate": "",

"pgtoken": "1234567",

"countrycode": "KOR"

},

{

"paytoken": "20240821HCH95D17M6PT",

"pginfo": "PLCreditCard",

"storeorderno": "bb1bbfdc-871c",

"payerid": "test123",

"amount": 1.00,

"currency": "USD",

"state": 2,

"ymd": "20240821",

"regdate": "2024-08-21 12:13:49",

"cnldate": "2024-08-21 13:13:49",

"pgtoken": "1234567",

"countrycode": "KOR"

}

]

}

}

In case of failure

HTTP 1.1 403 Forbidden

{

"error": {

"code": 993,

"message": "You do not have authorization.",

"detail": "Not allowed ip address.",

"plcode": 993

}

}

In case of success

| Parameter | Type | Description |

|---|---|---|

| data | object | |

| └ rowcount | object | Number of transactions |

| └ total | number | Total number of transactions |

| └ success | number | Number of success Transactions |

| └ cancel | number | Number of canceled transactions |

| └ datalist | json array | Transaction data |

| └ paytoken | string | Payletter payment unique number |

| └ pginfo | string | PG information |

| └ storeorderno | string | Store Order Number |

| └ payerid | string | Store payer (member) ID |

| └ amount | number | Amount of payment |

| └ currency | string | Currency code |

| └ state | number | Payment status code (1: OK, 2: Canceled, 3: Partial Cancellation) |

| └ ymd | string | Payment date |

| └ regdate | string | Registration date |

| └ cnldate | string | Cancellation date |

| └ pgtoken | string | PG transaction number (Transaction ID for PayPal) |

In case of failure

| Parameter | Type | Description |

|---|---|---|

| error | object | |

| └ code | number | Error Code |

| └ message | string | Error Message |

| └ detail | string | Error Detail Message |

| └ plcode | number | Other error codes |

Error Code

Success or failure for API request can be checked by HTTP StatusCode

In case of StatusCode 200 OK, request is in success, Except for this case, please refer to following StatusCode.

Table of Error code

| HTTP Response | Error Code | Error Message | Description |

|---|---|---|---|

| 400 | 997 | The request is invalid | request parameter error |

| 401 | 998 | Authentication token is missing or incorrect | authentication error |

| 403 | 993 | You do not have authorization | authentication error |

| 406 | 990 | Detail Error Message | Error processing business logic |

| 500 | 999 | Internal Error | system error |

Appendix

PG Code Table

| PGInfo | PGCode | PGSubCode | Description |

|---|---|---|---|

| PLCreditCard | PL | CreditCard | Unauthorized credit card payment |

| PLCreditCard_CY | PL | CreditCard_CY | Cybersource credit card payment |

| PLCreditCardMpi | PL | CreditCardMpi | Authorized credit card payment |

| PLUnionPay | PL | UnionPay | UnionPay |

| CCCherryCredits | CC | CherryCredits | CherryCredits (Prepaid card) |

| Codapay7ElevenPH | CodaPay | 7ElevenPH | 7Eleven (Convenience store payment) |

| CodapayAlfamart | CodaPay | Alfamart | Alfamart (Convenience store payment) |

| CodaPayBankTransferTHA | CodaPay | BankTransferTHA | Bank Transfer |

| CodapayCarrierBillingMaxis | CodaPay | CarrierBillingMaxis | Maxis (Mobile payment) |

| CodaPayCarrierBillingTMH | CodaPay | CarrierBillingTMH | TMH (Mobile payment) |

| CodapayDokuWallet | CodaPay | DokuWallet | Doku Wallet (E-Wallet) |

| CodaPayEtisalat | CodaPay | Etisalat | Etisalat (Mobile payment) |

| CodaPayFawry | CodaPay | Fawry | Fawry (E-Wallet) |

| CodaPayGcash | CodaPay | Gcash | Gcash (E-Wallet) |

| CodapayIndomaret | Codapay | Indomaret | Indomaret (Convenience store payment) |

| CodaPayKplus | CodaPay | Kplus | Kplus (Bank Transfer) |

| CodaPayPromptpay | CodaPay | Promptpay | PromptPay (Bank Transfer) |

| CodaPayRabbitLINEPay | CodaPay | RabbitLINEPay | Rabbit LINE Pay (E-Wallet) |

| CodaPayShopeePayTH | CodaPay | ShopeePayTH | ShopeePay (E-Wallet) |

| CodaPayTrueMoneyCashCard | CodaPay | TrueMoneyCashCard | True Money Cash Card (Prepaid card) |

| CodaPayTrueMoneyWallet | CodaPay | TrueMoneyWallet | True Money Wallet (E-Wallet) |

| CodaPayChunghwaTel | CodaPay | ChunghwaTel | ChunghwaTel (Mobile payment) |

| CodaPayCreditCard_TW | CodaPay | CreditCard_TW | CreditCard_TW (credit card payment) |

| CodaPayFareastone | CodaPay | Fareastone | Fareastone (Mobile payment) |

| CodaPayGashGiftCard | CodaPay | GashGiftCard | GashGiftCard (Prepaid card) |

| CodaPayJKOPay | CodaPay | JKOPay | JKOPay (E-Wallet) |

| CodaPayLinePay | CodaPay | LinePay | LinePay (E-Wallet) |

| DegicaBancontact | Degica | Bancontact | Bancontact (E-Wallet) |

| DegicaBankTransfer | Degica | BankTransfer | BankTransfer |

| DegicaBitCash | Degica | BitCash | BitCash (Prepaid card) |

| DegicaCreditCard | Degica | CreditCard | CreditCard |

| DegicaEPS | Degica | EPS | EPS (Bank Transfer) |

| DegicaIdeal | Degica | Ideal | iDEAL (Bank Transfer) |

| DegicaJapanMobile | Degica | JapanMobile | JapanMobile (Mobile payment) |

| DegicaKonbini | Degica | Konbini | Konbini (Convenience store payment) |

| DegicaLinePay | Degica | LinePay | LINE Pay (E-Wallet) |

| DegicaMerPay | Degica | MerPay | MerPay (E-Wallet) |

| DegicaMultibanco | Degica | Multibanco | Multibanco (Bank Transfer) |

| DegicaMyBank | Degica | MyBank | MyBank (Bank Transfer) |

| DegicaNetCash | Degica | NetCash | NetCash (Prepaid card) |

| DegicaPayEasy | Degica | PayEasy | PayEasy (Online Banking) |

| DegicaPayPay | Degica | PayPay | PayPay (E-Wallet) |

| DegicaPaysafecard | Degica | Paysafecard | Paysafecard (EPIN) |

| DegicaPrzelewy24 | Degica | Przelewy24 | Przelewy24 (Bank Transfer) |

| DegicaSofortBanking | Degica | SofortBanking | Sofort (Bank Transfer) |

| DegicaWebMoney | Degica | WebMoney | WebMoney (Prepaid card) |

| ICBAlipay | ICB | Alipay | Alipay (E-Wallet) |

| MOLAIS 12 Call Prepaid | MOL | AIS 12 Call Prepaid | AIS 12 Call (Prepaid card) |

| MOLFPX | MOL | FPX | FPX (Online Banking) |

| MOLLoadCentral | MOL | LoadCentral | LoadCentral (Prepaid card) |

| MOLMaybank2U | MOL | Maybank2U | Maybank (Online Banking) |

| MOLMOLPoint_PP | MOL | MOLPoint_PP | Razer Gold PIN (Prepaid card) |

| MOLTrueMoney | MOL | True Money | True Money (Prepaid card) |

| MOLzGold-MOLPoints | MOL | zGold-MOLPoints | Razer Gold Wallet (E-Wallet) |

| MyCardPPCard | MyCard | PPCard | MyCard (Prepaid card) |

| PaypalExpressCheckout | Paypal | ExpressCheckout | PayPal (E-Wallet) |

| VTCDomesticBank | VTC | DomesticBank | Bank Transfer (Bank Transfer) |

| VTCVTCPay | VTC | VTCPay | VTCPay (E-Wallet) |

| WeChatPayH5Payment | WeChatPay | H5Payment | WeChatPay (E-Wallet) |

| WeChatPayQRCodePayment | WeChatPay | QRCodePayment | WeChatPay (E-Wallet) |

| AlipayPlusAlipayHK | AlipayPlus | AlipayHK | AlipayHK (E-Wallet) |

| AlipayPlusBoost | AlipayPlus | Boost | Boost (E-Wallet) |

| AlipayPlusBPI | AlipayPlus | BPI | BPI(Online Banking) |

| AlipayPlusDana | AlipayPlus | Dana | Dana (E-Wallet) |

| AlipayPlusGcash | AlipayPlus | Gcash | Gcash (E-Wallet) |

| AlipayPlusKSNET_Alipay | AlipayPlus | KSNET_Alipay | KSNET_Alipay (E-Wallet) |

| AlipayPlusRabbitLinePay | AlipayPlus | RabbitLinePay | RabbitLinePay (E-Wallet) |

| AlipayPlusTNG | AlipayPlus | TNG | TNG (E-Wallet) |

| AlipayPlusTrueMoney | AlipayPlus | TrueMoney | TrueMoney (E-Wallet) |

| GASHLINEPay | GASH | LINEPay | LINEPay (E-Wallet) |

| GASHChinaUnionPay | GASH | ChinaUnionPay | ChinaUnionPay (credit card payment) |

| GASHCreditCard | GASH | CreditCard | CreditCard (credit card payment) |

| GASHGAMAPay | GASH | GAMAPay | GAMAPay (E-Wallet) |

| GASHGooglePay | GASH | GooglePay | GooglePay (E-Wallet) |

| GASHApplePay | GASH | ApplePay | ApplePay (E-Wallet) |

| GASHWebatm | GASH | Webatm | Webatm (Online Banking) |

| GASHSmartpay | GASH | Smartpay | Smartpay (E-Wallet) |

| GASHChunghwaTelecom | GASH | ChunghwaTelecom | ChunghwaTelecom (Mobile payment) |

| GASHfareastone | GASH | fareastone | fareastone (Mobile payment) |

| GASHtaiwanmobile | GASH | taiwanmobile | taiwanmobile (Mobile payment) |

| GASHGiftcard | GASH | Giftcard | Giftcard (Prepaid card) |

| GASHEPIN | GASH | EPIN | EPIN (Prepaid card) |

| GASHPPCard | GASH | PPCard | PPCard (Prepaid card) |

| AlipayKKAlipayCN | Alipay | KKAlipayCN | AlipayCN (E-Wallet) |